sales tax in irvine ca 2019

The average cumulative sales tax rate in Irvine California is 775. The current total local sales tax rate in Irvine CA is 7750.

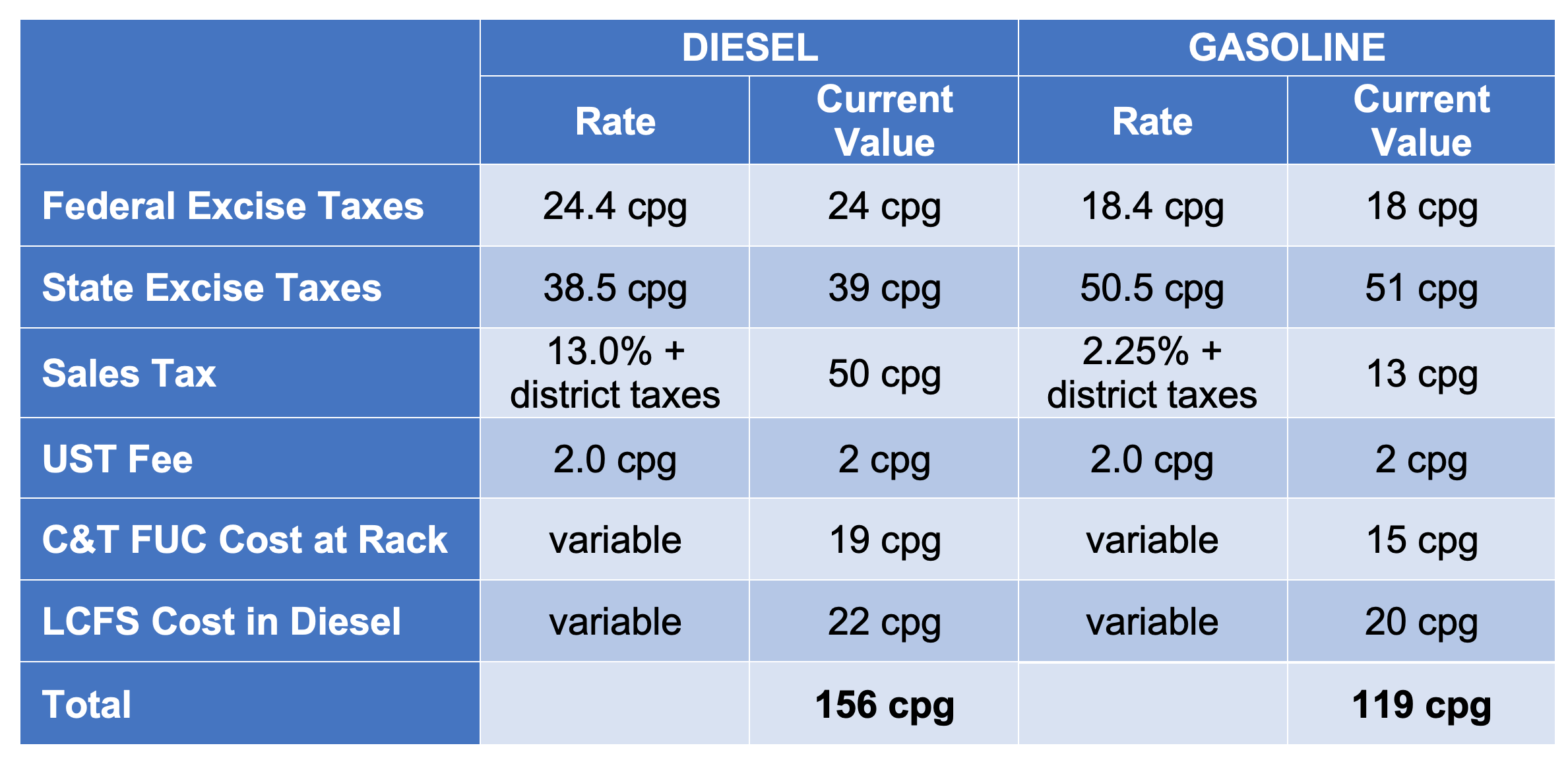

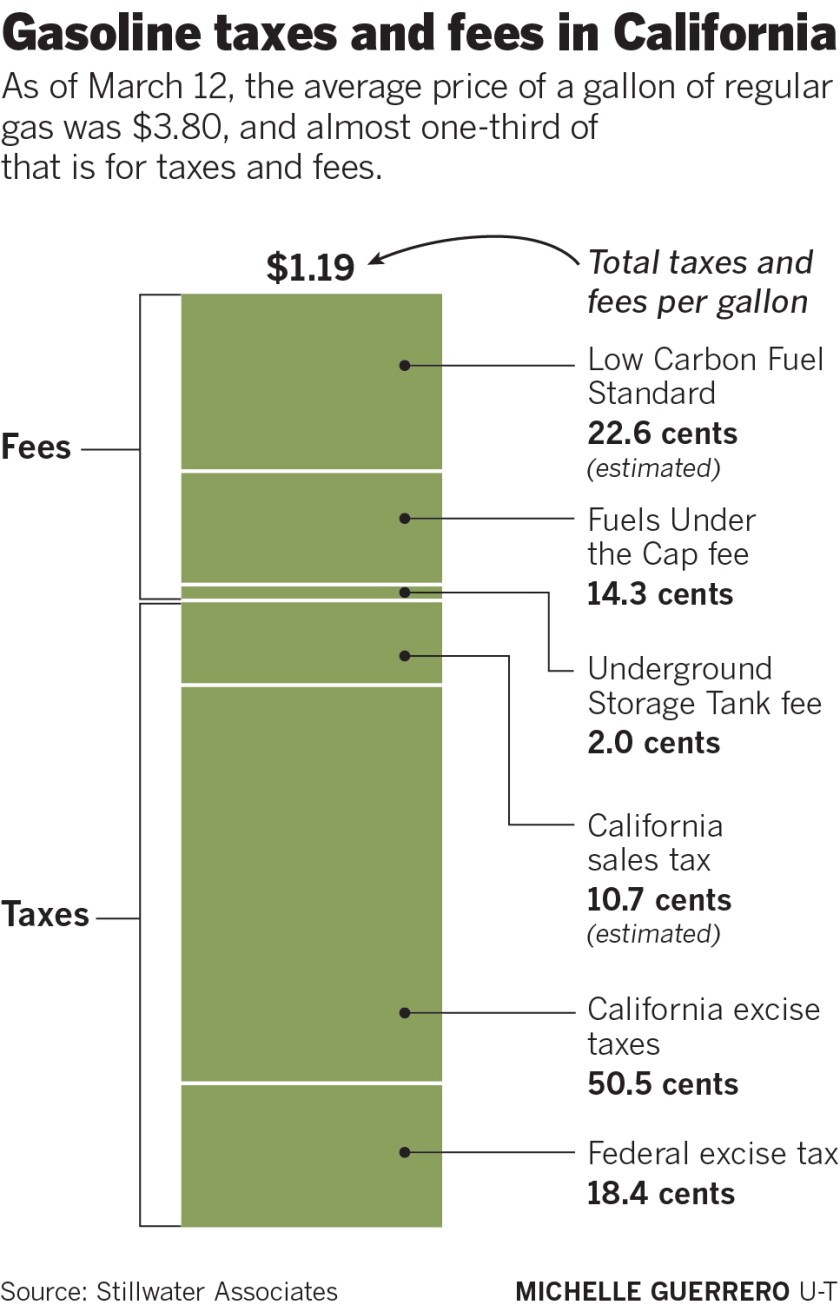

Taxes And Fees Drive California S High Diesel Prices Stillwater Associates

The 775 sales tax rate in East Irvine consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax.

. What is the sales tax rate in Irvine California. The combined rate used in this calculator 775 is the result of the California state rate 6 the 92618s county. The sales tax jurisdiction.

Transparent Flexible Fixed-Fee Pricing. This is the total of state county and city sales tax rates. 05 for Countywide Measure M Transportation Tax.

4 rows The current total local sales. 63 Crater Irvine CA 92618 2500000 MLS OC22137877 This newly built 2019 Altair home is designed with comfort in mind as you. Our Team Includes CPAs Lawyers Former Auditors Other Sales Tax Professionals.

2020 rates included for use while preparing your income. Ad Your Business Partner for All Things Sales Tax. The 92618 Irvine California general sales tax rate is 775.

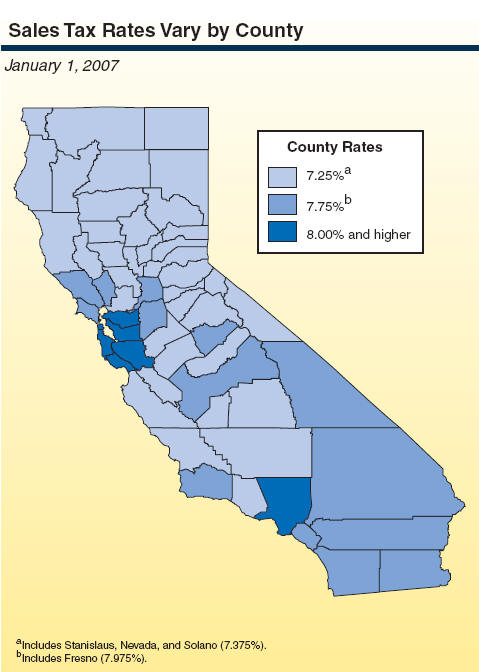

Irvine is located within Orange County CaliforniaWithin. What is the tax rate in California 2019. California City County Sales Use Tax Rates effective April 1 2022 These.

There is no applicable city tax. 66 Crater Irvine CA 92618 2990000 MLS TR22171757 Stunning NEXTGEN Home with Corner Lot located in Altair Irvine 24-hour Guard. Transparent Flexible Fixed-Fee Pricing.

This includes the rates on the state county city and special levels. Save up to 7976 on one of 234 used 2019 Toyota 4Runners in Irvine CA. The December 2020 total local sales tax rate was also 7750.

725 for State Sales and Use Tax. 4 beds 35 baths 3192 sq. 4 beds 6 baths 4243 sq.

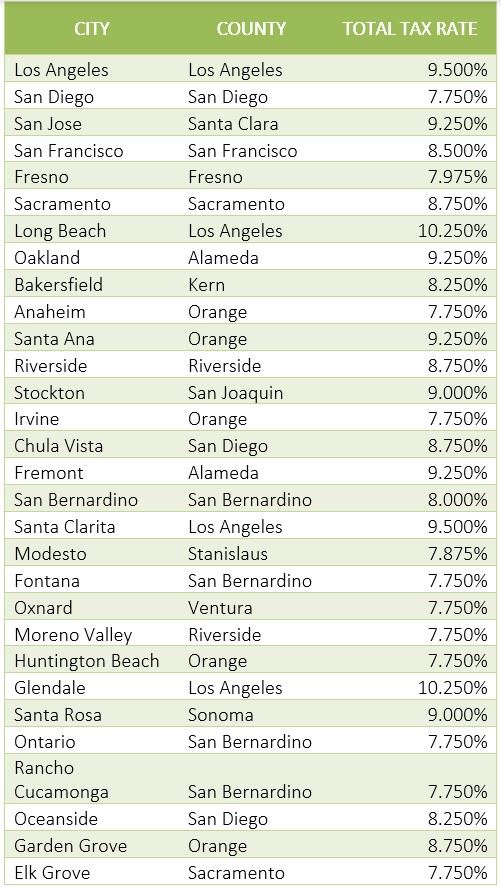

The minimum combined 2022 sales tax rate for Irvine California is 775. 1788 rows California Department of Tax and Fee Administration Cities Counties and Tax Rates. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent.

Enter your income and we will give you your estimated taxes in Irvine California we will also give you your estimated taxes in Fremont California. The latest sales tax rates for cities starting with A in California CA state. Our Team Includes CPAs Lawyers Former Auditors Other Sales Tax Professionals.

Rates include state county and city taxes. An alternative sales tax rate of 775 applies in the tax region Irvine which appertains to zip code 92782. Find your perfect car with Edmunds expert reviews car comparisons and pricing tools.

Ad Your Business Partner for All Things Sales Tax.

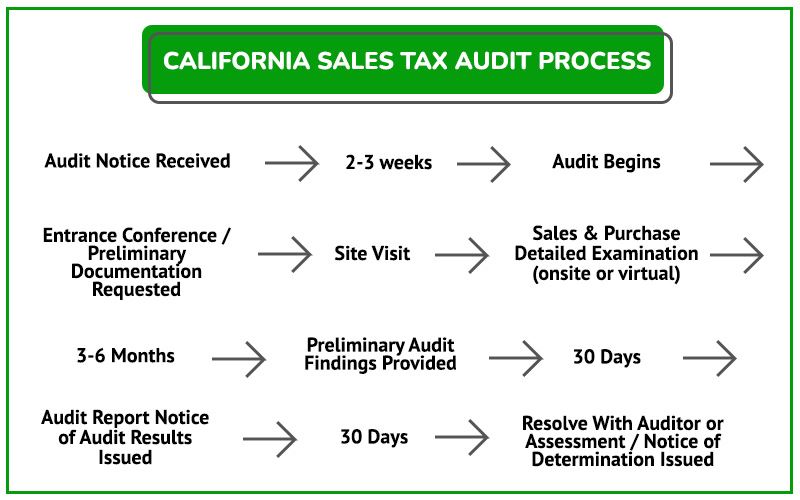

California Sales Tax Guide For Businesses

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review

Orange County Ca Property Tax Calculator Smartasset

California Sales Tax Guide For Businesses

2022 Property Taxes By State Report Propertyshark

California Sales Tax Guide And Calculator 2022 Taxjar

All About California Sales Tax Smartasset

387 Vista Baya Newport Beach Ca 92660 5 Beds 4 5 Baths

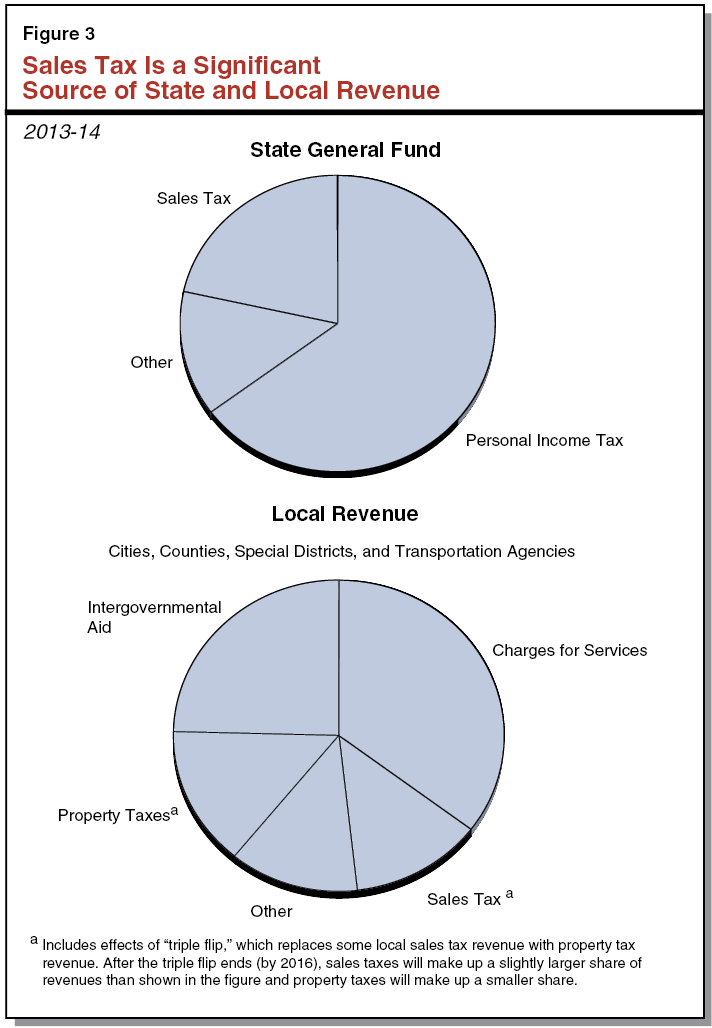

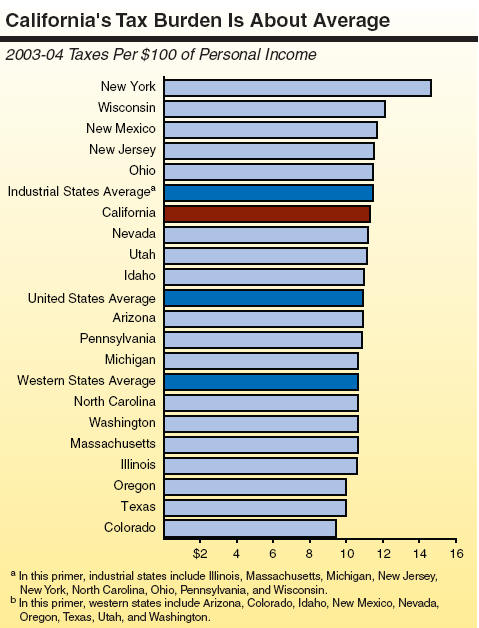

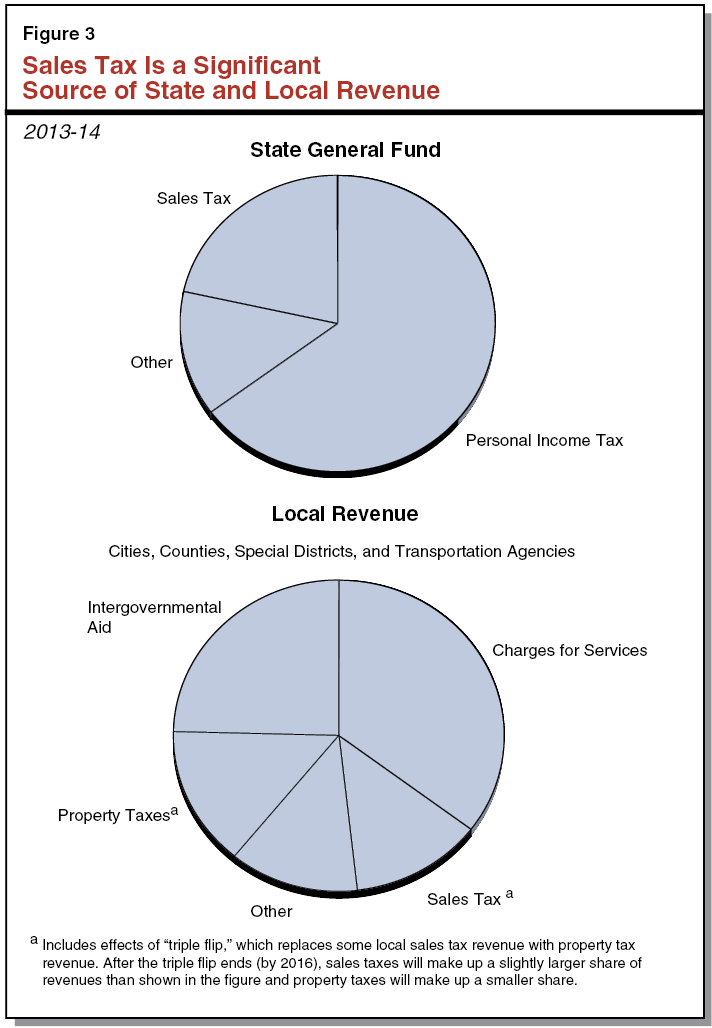

California S Tax System A Primer

How Much Are You Paying In Taxes And Fees For Gasoline In California The San Diego Union Tribune

What Are Good Ways To Use Your Tax Refund Tax Refund Reduce Debt Personal Loans

Associate Attorney Resume Example Resume Examples Resume Guide Guided Writing

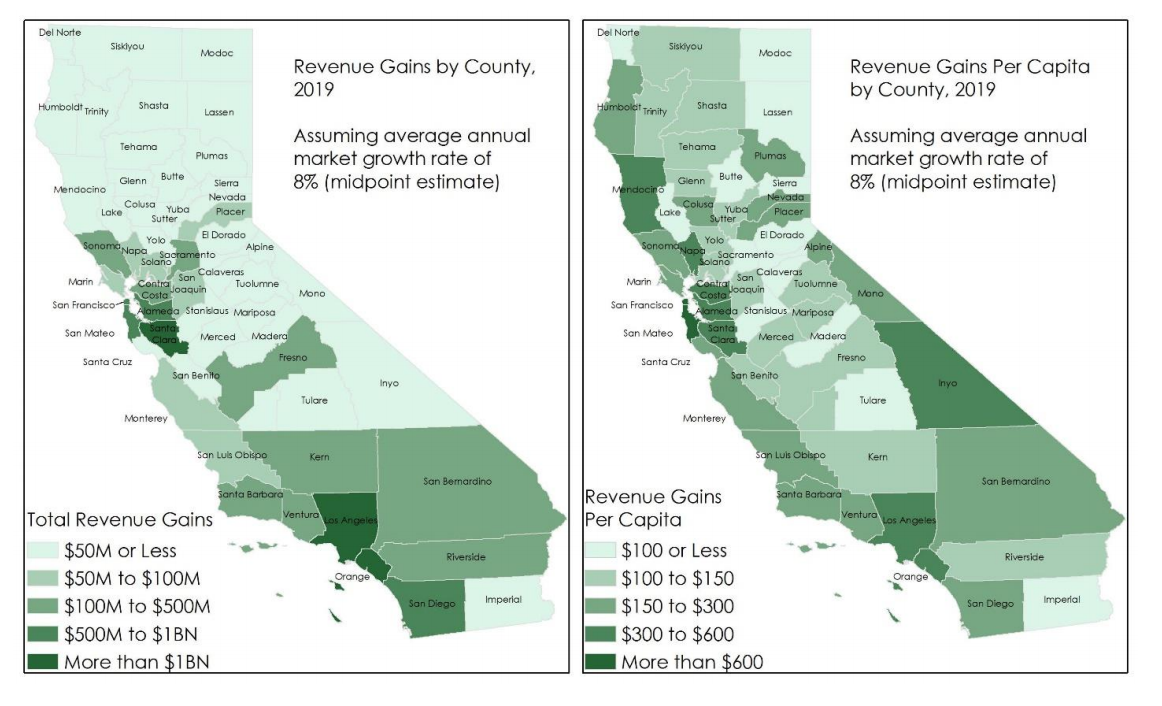

Understanding California S Sales Tax

California Sales Tax Rate By County R Bayarea

California City County Sales Use Tax Rates

Tax Spreadsheets For Photographers Tax Guide Budget Help Spreadsheet

Understanding California S Sales Tax

Associate Attorney Resume Template Resume Tips Resume Words Resume Guide